As some of you know, I recently proposed to my long time girlfriend (and she said yes!) during a trip to London and the hunt began for a wedding ring. I didn’t dare pick one out for her since I know she had very specific ideas on these things, so I proposed with a cheapish Tiffany’s silver ring and told her we’d pick out a ring together when we got back to the states. We found one relatively quickly that we both liked but it was way more than I had budgeted. It wasn’t her going crazy but more an issue of me not realizing what jewelry costs. Luckily, the store had 0% financing through Wells-Fargo so I thought I was all set. This is what I wish I’d known then.I didn’t really want to finance the ring, but I knew I had a big check coming in about 9 months that would cover the cost so I wasn’t too worried about it. The staff said it was 0% financing as long as you paid in full within a year and this way we would have the ring 9 months early. They didn’t know much more than that – just that they took our info and typed it into the computer and it told them how much we were approved for. So we filled out the forms, co-signing so that we’d have a better chance to be approved, and were approved for $10,800 which was almost the cost of the ring.

Now please don’t everybody comment about how little that is, or how they would never spend that much on a ring. My fiancé and I looked at our budget together and made an informed decision that made sense for us given our priorities and life situation. I would expect any of you to do the same.

Now let me tell you how I assumed this would work. I originally assumed at first that I could just not pay for nine months, and then pay in full when my check came in and we’d be all set. I did realize before signing anything that there would be a minimum payment each month. Luckily they wouldn’t charge interest for the first year, but if you didn’t have it paid off by then, they would charge you all the back interest they should have charged you from the beginning. Several other loans I had looked at were in the 10% range and most of the credit cards I have average about 15% so that’s what I assumed this would be at max. I also assumed that it would appear on my credit report as an installment loan much like student debt or a car; this was actually a plus for me since it would increase the types of debt I have.

A few weeks after we pick up the ring, we got a packet in the mail from Wells Fargo and I could instantly tell that many of my assumptions were wrong. In the packet was some information as well as a credit card with mine and my fiancé’s names on it. Apparently, this isn’t a loan but a credit card. They give you a credit card for the amount you’re approved for and instantly max it out. Those of you who know about your credit report know that this impacts your credit score in three ways: 1) It counts as a hard inquiry. 2) It lowers the average age of your credit accounts since it was just opened. 3) It comes maxed out which increases your debt to credit ratio and is a big flag on your report. You should try not to use over 30% of your credit limit on any single card since doing more can be a sign that you are living on credit and can’t afford it.

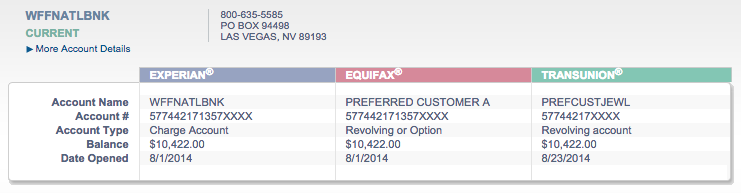

I did some more digging and looked at my credit report on Credit Secure, which is a product operated by American Express. They show that all three credit agencies report it as a retail card and show it being almost maxed out. In another area it tells you what is negatively affecting your score and they all three mentioned the over 90% usage on a credit card as a detrimental factor. It dropped my score by about 20 points. The image below is after I made the first payment.

The welcome packet also told us that the monthly payment would be $378 – no negotiation and no knowledge before making the decision. And at that point, it’s not even a take it or leave it offer since you’ve already taken it and there’s nothing you can do. And if you don’t have it paid off within a year, the interest rate is a whopping 28%, which they also didn’t tell you before you applied to this credit card you didn’t know you were getting. That’s the same range as payday loans. If you owe even a dollar when that one year mark hits, you’re looking at a couple thousand dollars in interest at least.

These last points are pretty annoying and extremely consumer unfriendly but I guess I should have known I’d have no control over those things. What really upset me is the affect to my credit score. I’m just starting out in life and don’t have a ton of cash or I would have just paid cash for the ring. My score it really important to me right now and them doing things to lower that score without me knowing is a huge deal. I see this as preying on people they know are desperate and taking advantage of them. At the very least it is consumer unfriendly not to have all of this information available before you sign up. it’s not on the packet and it’s almost impossible to find online. Really, the store employees should have known but Wells-Fargo specifically bills this to businesses as them not having to know or understand anything so I can’t really blame them too much.

So what do I do going forward? Well, I pay the monthly payment until I get that big check and use it to pay off the rest before the year is up. Then I cut up the card and never use it again. And when it comes time to look at a new bank or a bank for an auto loan or mortgage, you can sure as hell bet Wells-Fargo won’t get my consideration.

Hopefully somebody sees this before they sign up for the Jewelry Dis-Advantage Card so that they at least know what they’re getting into before they do it. If you’ve got any questions about it, ask them in the comments below and I’ll try to get back with you as soon as I can.

I’m in almost the exact same situation. Just remember you can always balance transfer the amount to another card you have with a higher credit limit. You’ll pay the balance transfer fee, but then your utilization score with go down, bringing your credit score back up.

I considered that but in addition to the fee to balance transfer I’d have to start paying interest immediately since I don’t have any 0% APR cards. And it would still be affecting my credit substantially, just slightly less than it was. In the end, I decided that the hit on my credit report wasn’t that bad since I won’t be applying for any loans in the next year or two. Good advice though!

Did Wells Fargo not give you the ability to cancel the purchase? I thought in most states there’s a 30 day window?

Could you take them (the store you purchased it from) to court?

This just happen to me, Wells Fargo won’t help. I was told it was not a loan SEVERAL times from the jewelry store worker and they charged the card but I got a credit card in the mail and it ruined my credit with high utilization.

I am thinking of filing a complaint to my state’s dept of consumer affairs for the store misleading me. The store has yet to respond to my inquiries of returning the ring.

I might be able to but in the end it would be my word against theirs that they didn’t tell me and it would cost more to fight than it’s worth. I was finally able to pay it off last month so I’m excited for it to stop messing with my credit. I made sure to pay $1 over what I owed so that I would have a negative balance on the card and when I call to cancel it, they’ll have to mail me a check for that $1. It may only cost them 30-40 cents to do that but it’ll make me feel better. It’s the little things 🙂

This is no big deal. Pay it off in the 0% time and the account shows full payment and your credit will go up. If you are savvy you would have known it is a credit card. Apple does the same with their rewards program.

If one was capable of “paying it off” in “0%” time then they have no need to apply for a loan/credit card to begin with.

If you’re told “it’s not a credit card” and credit card related applications are not apart of your profession then you don’t lack being savvy – you were being deceived by a professional who does these types of transaction everyday as part of their job duty.

What do you suggest instead of the Wells Fargo plan? I am looking to get a ring in the near future and am looking up some information on payment plans before I get brainwashed into signing up with whatever loan/credit options the jeweler offered. The jeweler I’ll be using uses Wells Fargo. If you hadn’t had gone that route, which route Would you have taken?

I’m not sure what I would have done. One option would be to go to a different jeweler who offers financing without a credit card. But that’s going to be harder to find and if you find the perfect ring, good luck convincing her to look elsewhere. Another option would be to get a personal loan from a bank. When I looked into this I had trouble since I couldn’t find a bank that would use the ring as it’s own collateral so I would have to have my own collateral. Even with that, the interest rate would be around 9-10%. Another option is to get a credit card that has 0% interest for the first year. This is very similar to the Wells Fargo stuff but in this case, you could control how much was charged on the card so you would be able to guarantee you stayed below 50% utilization rate. Also, your monthly minimum payment would be about 25% of what it is with Wells Fargo. You could maximize this by signing up for 2-3 cards that offer 0% interest for the first year on the same day; then just put 1/2 to 1/3 of the purchase on each card. Or, if you have any kind of business, you can get a business credit card that offers 0% (like chase ink cash) and put it all on that. Business cards use your SSN to apply and approve but don’t report back to your credit report so it doesn’t matter if it is maxed out.

Hopefully this gives you an idea about some of the options out there. Honestly, what I wish I had done is bought the ring setting with a $100 cubic zirconia stone and paid for that in full. Then I could have had 18 months to save and buy the real diamond before the wedding. This isn’t really that traditional but we both think it would have worked out better in the end. She wanted a ring to be wearing and nobody needs to know it isn’t real but you two. Anybody who thinks they can tell is wrong. And I figure as long as the real diamond is in it for the wedding, it’s all good.

Update:

I did legal research, the jewelry company that did this to me are respectable and is working with Experian to correct the damage this “store credit” card, that I was told was not a credit card, has done.

I suggest financing through an installment loan which won’t affect your credit like a revolving credit card or apply for a personal loan with your bank preferable a union bank.

This has been a headache and I’m glad I’m not the only one that went through this but good for you for being able to pay off the entire balance quickly!

All 0% interest free for a year cards or accounts are set up exactly like this. Its free cash for a year. If you dont pay every dime by the end of that year, its not free cash anymore and they do charge you the interest. Now that you know, you should use these cards amd promotions to your advantage. Just put the pay date in your phone calender so you dont get burned.

I opened the same Wells Fargo account when I bought my fiancee’s ring a year ago – at the time I didn’t realize average length of credit account and ratio of available credit to outstanding debt impacted your credit score. Now that everything’s paid off, shouldn’t you (we) try to keep that line of credit open for as long as possible? I’m not sure how long they keep it open without inactivity, but maybe keeping it open is a good idea to increase the average length of credit and total credit limit for credit scores.

Great question alvo! I’m pretty sure that everything that I’m about to say is correct, but as always I offer it for free and with no guarantees. From an analytical point of view, you are completely correct. Average age of account and ratio of credit/debt are significant factors in determining your credit score so keeping those portions good will be a big help.

As soon as you close your Wells Fargo account you will lose that credit line. This will increase the ratio of debt/credit, which should lower your credit score. However, this will vary a lot depending on how much available credit you have. For instance, if you have a total credit line of $100,000 and you lose $10,000, I’m not sure this would impact your score very much. But if you only have $20,000 and you lose $10,000, it will impact your score a lot. I don’t know the exact model used by FICO but I generally feel like any ratio under 10% is generally very low and considered about the same. Above that 10% point, I’m not so sure.

As for the average age of accounts, I’m pretty sure that even closed accounts continue to contribute to your average age of account for 10 years after you close the account. So this will eventually affect you but not for awhile and hopefully by then you’ll have some other old cards that will reduce that effect a little.

However, from a practical point of view, it’s one more account to worry about and keep up with and I’m not sure it’s worth the effort. And from an emotional point of view, I’m just done with Wells Fargo and don’t want to be involved with them in any way moving forward. But those are just my feelings, I’d be interested to hear yours.

Hard to believe someone with THAT much money to blow on a rock doesn’t understand how credit works. Lol.

You are terrible! I bet you think you are Mr. Perfect! Jealous much??!!

It’s hard to believe that someone with THAT much money to blow on a rock doesn’t understand how credit works. You’re an engineer?

I am, and a good one at that. And I understand better than most how credit works. Doesn’t matter when they lie to you. And even if they didn’t, my message is that this is a bad way to finance a ring. But thanks for your snarky remarks anyway.

I just got that credit card to purchase my husband a nice gift for christmas, They told me everything you have said you did not know upfront. I need to pay a minimum montly and I need to pay it before 15 months in order to not have the interest charges… So no sure why the store you went to would not tell you all this info. Could it be you were too excited to pay attention to these details? Seems odd.

Nope, I did this process over two weeks and did hours of research trying to understand how the financing would work. Of course I knew that we had 12 months to pay it off and had to make payments, that’s the easy part. But they don’t make it clear that it is a credit card they are signing you up for (and maxing out). They just didn’t tell us or lied when we asked. As I said, my fault for assuming it would be standard financing but I maintain that this is still one of the worst ways to finance a ring for somebody who cares about their credit score.

To whom it may concern. I got this card and it was not a problem. In fact, it helped raise my credit score 30 points in 6 months. The reason is My total credit line prior was $3,000. They approved me for $5200 and I only charged $2,000 (6 months no interest) So, point being my overall line raised to 8200 my credit utilization went from near 100 percent bc my cards were maxed to 40 percent. So, of course any multi thousand dollar card you get and hold a max balance will lower your score! Point being dont carry any balances you cant pay off that same month. Or do a deferred interest option on your purchases so you dont pay interest!

What did you expect? They’re not just giving you free money. You were able to purchase a ring that you otherwise couldn’t afford. Unless you’re trying to purchase a home in the next year (which it doesn’t sound like), the 20-point hit on your credit is not a big deal. Once you pay off Well Fargo it’ll go back up, probably even higher than before because you’ll have more available unused credit and a longer average age of your accounts.

Good point on the payment though. Make sure you pay every cent within the year to avoid a huge interest fee.

Yeh a 20 point hit may be something I would be ok with, IF that had been disclosed. (Turns out it isn’t something I would have been ok with because it limits new credit cards I can apply for but that’s neither here nor there). The wells fargo program is designed to be as unclear as possible so that people don’t realize they are maxing out a credit card. At least in the last year, they’ve changed it to make it a little more explicit that it’s a credit card – before that it just called it the Jewelry Advantage Card.

This just happened to my son and in this case the fault lies completely with the jeweler. He was shopping for an engagement ring and the one his fiance wanted was more than he had saved. As I wasn’t there I assumed the store discussed financing options and I’m sure what he filled out was a credit application. I’m thinking it was explained to him that this would be a credit card account because he specifically asked the sales person if by signing it he would be getting a credit card. She told him NO it was just to check his credit. Thankfully he thought about it and did not purchase the $5,800 ring. He is just starting out too and trying to build his credit and unfortunately for my future daughter-in-law he realized the “death trap” he is driving will not pass the next inspection and the priority right now is a new vehicle. He had called and told me all of this so imagine my surprise when opening yesterday’s mail I find a credit card from Wells Fargo Jewelry Advantage with a credit limit of-yep, you guessed it, $5,800. I put it aside and figured I’d talk to him about in the morning. Then he called me today from the car dealership because his car barely gets him back and forth to work. He asked about financing, insurance, etc, since his cars have been titled under me or his father and he’s been covered on either one of our insurances. So I thought I should mention the Wells Fargo card, needless to say he was quite upset and angry. That’s when he told me the sales person told him he would not be opening an account, that they were just doing a credit check. Not really sure who is at fault. He tried to call the credit card and conveniently they are not open on the weekends. So we are waiting for jeweler to open. He’s so nervous as he has put money down on a car and now he has this open account. He doesn’t know if leaving it open or closing it would affect his credit score negatively. I don’t see this as people not paying attention to details or being starry eyed in love. This is retailers taking advantage of consumers and consumers need to step up and fight back. If it comes down to either the jeweler or Wells Fargo inappropriately opening this account I will help my son file complaints with the proper consumer and governmental agencies

Yep. My Husband just paid off the credit card, because the high utilization will hurt his credit month to month and he left the account open because closing it will hurt his credit.

The Wells Fargo credit card will close after 18 months of no usage. So I suggest keeping it until to closes itself.

The jeweler said it was a loan and they were just seeing what he was qualified for. Turns out we got a credit card in the mail too. Hurts your credit either way as it is a hard inquiry.

The jeweler did little to fix the problem.

I completely agree – this is Wells Fargo and the jeweler purposely keeping things unclear to take advantage of people. As if anybody thought Wells Fargo was a good company to begin with – look at all the trouble they’ve been in recently with widespread fraud going back at least a decade. Hope all works out well for your son. Worst case scenario, you can file a complaint with the CFPB and get the credit card removed from his record because he was lied to.

Do you have one year interest free from the date of purchase or one year from opening the account?

I believe it is date of opening the account. For me it was the same date since they opened it and then immediately maxed it out.

I just used this plan to purchase an engagement ring for my fiancé a couple months ago. I was able to do a 3 year plan with 0% interest. My credit is terrible right now anyway, I got a co-signer. From what I’ve read it doesn’t seem to be that big of a deal, your credit takes a little hit for a year? I mean, you just got a ring for 10k with no interest for a year. Or in my case a ring for 6k with no interest for 3 years, I can take a little hit to my credit. Is that the only issue you had??

Yep that’s it. I had lots of other ways of financing the ring with 0% interest with a credit card. That would have been much easier and I could have gotten it for 18 or 24 months instead of 12. But I didn’t want the hit to my credit and wouldn’t have done it had i known it was a credit card. I previously had really good credit and this maxed out credit card greatly limited the number of new credit cards I could apply for in the last few years.

However, I maintain that financing a ring by putting it on a credit card is the worst way to do it. That’s why I’m saying don’t get this card, do it another way.

I’m in the same boat as you. My credit score is terrible and I have someone who has a 890 credit score thats going to cosign. Hopefully I get approved for the amount of the ring. If you don’t mind me asking, was your cosigners credit score good? Also, how terrible do you consider terrible?

890 credit score?? I assume you meant 790 which is still about as good as It can get. You should be able to get anything you want with a co-signer like that. Terrible is anything 550 or under…

This is….how basic cards work. Anywhere. This is credit 101. I want to second what someone else said….given your informed decisions, if you folks make enough to make a payment on a ring of that nature, there should be some more time invested in understanding how credit works, as a general rule.

Hi Dain and thanks for your snarky remarks. I agree that is how credit cards work. However, this was not pitched as a credit card that they max out for you. It was pitched as financing – which is typically seen as an installment loan on your credit report and you aren’t severely punished for having a 100% utilization ratio. Other examples would be financing furniture, appliances, or a car. In fact, because I’ve never had an installment loan, this would have raised my account and one of the reasons I did the financing was to get an installment account on my credit report.

So either I’m an idiot who can’t use credit. Or two businesses based on commission make things opaque and lie in order to get a sale. I’ll let you decide for yourself.

Well, I am glad you pulled yourself out of your dilemma! I think you have learned a valuable lesson, although I sincerely believe you are way too hard on yourself! There are a lot of con artists, fraudulent people, and corporations in our world, and sometimes we just happen to step right in their scam. Remember the mortgage scam, remember how many millions of people who were sold fraudulent mortgages with sophisticated, confusing terms! We were unaware of the new harsh, questionable terms that were placed on individuals for mortgages, it was something new and something very unfamiliar and unethical on so many levels! So, in the future we must be super careful and start checking reviews first before making any purchases,(Yelp, consumer reports, rip off, etc), or contracts with companies, research before we buy, as companies have become extremely unscrupulous!!

Ok I got the awful card. Approved for 6200 put $1000 down. I owe $5200. I got it for 24 months for 9.9% apr. what are my best options here? I plan on buying a house within a year. I have two other credit cards. A regions for $1000 and Southwest card for $7500. So all in all I have $14700 credit total.

I wish I had discovered this article before going along with this wells fargo account. I am being robbed but am unable to do anything about it. Wells Fargo has officially become the bandits, and we who go ahead with this account become those that are being robbed on a train. I pay slighty more than the minimum payment every month but am hit with an interest charge that is almost half of my payment. I am the fish in the barrel, while they are holding the gun.

FYI – the Wells Fargo Jewelry Advantage “card” can be used for more than just jewelry purchases. I was able to purchase a fine art painting at an art gallery using my account. They gave me a credit line of $7K, but the painting that I wanted was ‘just’ $500 at a 20% off discount during a promo period, and the payment plan was for 24 months interest free financing. To me it was a no brainer to sign up, whether this was an actual “credit card” or not. For the record, I think they told me as well that this was not a credit card. When I went back to the dealer a few days ago to look at more art the manager looked up my account and was wondering why it had an ‘expiration date’. Heh. Either way, it has helped me pay for the painting I wanted and I am planning to go back and buy another one!